CMS Payer Audit Strategies

Things Every Payer Should Know about a CMS Audit

Summary:

In the dynamic landscape of the healthcare industry, ensuring the financial stability and compliance of health insurance payers is crucial. One of the critical measures undertaken by the Centers for Medicare and Medicaid Services (CMS) is conducting audits on at-risk payers, including Independent Physician Associations (IPAs) and Management Service Organizations (MSOs). This article delves into the intricacies of a CMS audit, its significance, the profound impact it has on the audited entities, as well as an AI claims software that may be able to save you millions in overpaid claims as well as fines from CMS or even being placed on the excluded provider list.

The Role of CMS in Healthcare Regulation

The Centers for Medicare and Medicaid Services (CMS) plays a pivotal role in regulating and overseeing healthcare programs in the United States. As a federal agency under the Department of Health and Human Services (HHS), CMS is responsible for ensuring that healthcare services provided to Medicare and Medicaid beneficiaries meet specific standards of quality, safety, and financial integrity.

CMS administers various healthcare programs, including Medicare, which provides coverage for seniors and certain individuals with disabilities, and Medicaid, which offers healthcare services to low-income individuals and families. In order to protect the interests of beneficiaries and ensure the sustainability of these programs, CMS establishes guidelines, regulations, and standards that health insurance payers must adhere to.

Rationale Behind CMS Payer Audits on At-Risk Payers

CMS conducts audits on at-risk health insurance payers, such as Independent Physician Associations (IPAs) and Management Service Organizations (MSOs), to assess their compliance with CMS regulations and guidelines. These audits are essential for several reasons:

First, they help identify potential risks and areas of non-compliance within the payer's operations. By thoroughly examining financial records, claims processing, provider network management, and other critical aspects. CMS audits provide an opportunity to identify deficiencies, gaps, and instances of fraud or abuse.

Secondly, CMS audits ensure that payers are effectively managing the financial resources entrusted to them. The financial viability of payers is crucial to ensure the timely and accurate payment of claims to healthcare providers and the availability of quality care for beneficiaries. Audits help assess the solvency and reserve adequacy of payers, reducing the risk of financial instability and protecting beneficiaries' access to care.

Explaining Independent Physician Associations (IPAs)

Non-compliance with CMS regulations can have severe consequences for both health insurance payers and beneficiaries. Payers found to be in violation of CMS guidelines may face penalties, fines, and sanctions. These penalties can range from monetary fines to termination of contracts with CMS programs, leading to the loss of a significant portion of their customer base.

For beneficiaries, non-compliance by payers can result in disruptions in healthcare services, denial of claims, and limited access to quality care. It can compromise patient safety, timely access to necessary treatments, and the overall patient experience. CMS audits aim to ensure that payers fulfill their obligations to beneficiaries and maintain the highest standards of care delivery.

By conducting audits, CMS aims to uphold the integrity of healthcare programs, protect beneficiaries' rights, and hold payers accountable for their responsibilities. These audits serve as a means to identify and rectify issues, ultimately enhancing the quality, transparency, and efficiency of healthcare services provided by at-risk payers.

Explaining IPAs and MSOs

Independent Physician Associations (IPAs) are organizations that bring together independent healthcare providers, such as physicians, specialists, and other healthcare professionals, to collectively negotiate contracts with health insurance companies. IPAs serve as intermediary entities that enable individual providers to maintain their independence while leveraging the collective bargaining power of the association.

IPA Functions and Objectives

The primary function of an IPA is to facilitate contracting and reimbursement negotiations between its member providers and health insurance payers. By negotiating as a group, IPAs aim to secure favorable contractual terms, such as reimbursement rates and utilization management requirements. Additionally, IPAs often establish provider networks and referral systems to promote collaboration and improve care coordination among their members.

The objectives of IPAs include enhancing the financial viability of independent providers, improving patient access to a broad range of services, and promoting quality of care. IPAs also offer administrative support services, such as billing, credentialing, and claims processing, which help streamline operations for their member providers.

MSO Responsibilities and Functions

Management Service Organizations (MSOs) are entities that provide administrative and operational services to healthcare providers, including IPAs and individual practices. MSOs help streamline the business aspects of healthcare delivery, allowing providers to focus on patient care while outsourcing non-clinical functions.

MSOs offer a range of services to healthcare providers, including practice management, revenue cycle management, human resources, information technology, and compliance support. They assist with tasks such as billing and coding, financial management, electronic health record implementation, recruitment and staffing, and regulatory compliance.

The primary responsibility of an MSO is to ensure efficient and effective operations for its affiliated providers. By leveraging economies of scale and expertise in administrative functions, MSOs aim to optimize revenue, reduce costs, and improve overall practice performance.

MSO Responsibilities and Functions

MSOs often collaborate closely with health insurance payers to facilitate provider network development, contract negotiations, and claims processing. They act as intermediaries between payers and providers, working to ensure smooth communication, efficient operations, and compliance with payer requirements.

MSOs may assist providers in navigating payer contracts, understanding reimbursement methodologies, and implementing utilization management strategies. They help providers meet payer network adequacy requirements, manage credentialing and enrollment processes, and address payer audits or compliance inquiries.

In summary, IPAs and MSOs are instrumental in the healthcare landscape, supporting independent providers by facilitating contract negotiations, administrative support, and operational efficiency. These entities play a vital role in improving access to care, promoting collaboration among providers, and optimizing healthcare delivery for the benefit of both providers and patients.

Pre-Audit Preparations and Notifications

Before the commencement of a CMS audit, the audited health insurance payer receives a notification from CMS indicating the audit's scope, objectives, and timeline. This notification serves as an opportunity for the payer to prepare for the audit process. Preparations may involve assembling a dedicated audit team, identifying key personnel responsible for audit coordination, and gathering relevant documentation and records.

The payer should review its policies, procedures, and processes to ensure compliance with CMS regulations and guidelines. Conducting internal assessments and self-audits can help identify areas of potential non-compliance and address any deficiencies proactively. It is essential for the payer to establish effective internal controls, document management systems, and quality assurance mechanisms to facilitate a smooth audit process.

On-Site Audit Procedures

Once the pre-audit preparations are complete, the CMS audit team will arrive on-site to conduct the audit. The duration of the on-site audit may vary depending on the size and complexity of the payer's operations. The audit team will follow a structured approach to assess various aspects of the payer's performance and compliance.

Evaluation of Financial Records and Operations

The audit team will review the payer's financial records and operations to ensure solvency and financial integrity. This evaluation involves assessing the payer's financial statements, reserves, and claims liabilities. The team will examine the payer's financial management processes, including budgeting, accounting practices, and risk management strategies.

Furthermore, the audit team will analyze the payer's revenue streams, reimbursement methodologies, and payment processes to verify the accuracy and timeliness of claims payments. They will scrutinize the payer's contractual relationships with providers and assess the adequacy of reimbursement rates in accordance with CMS guidelines.

Analysis of Claims and Payment Processes

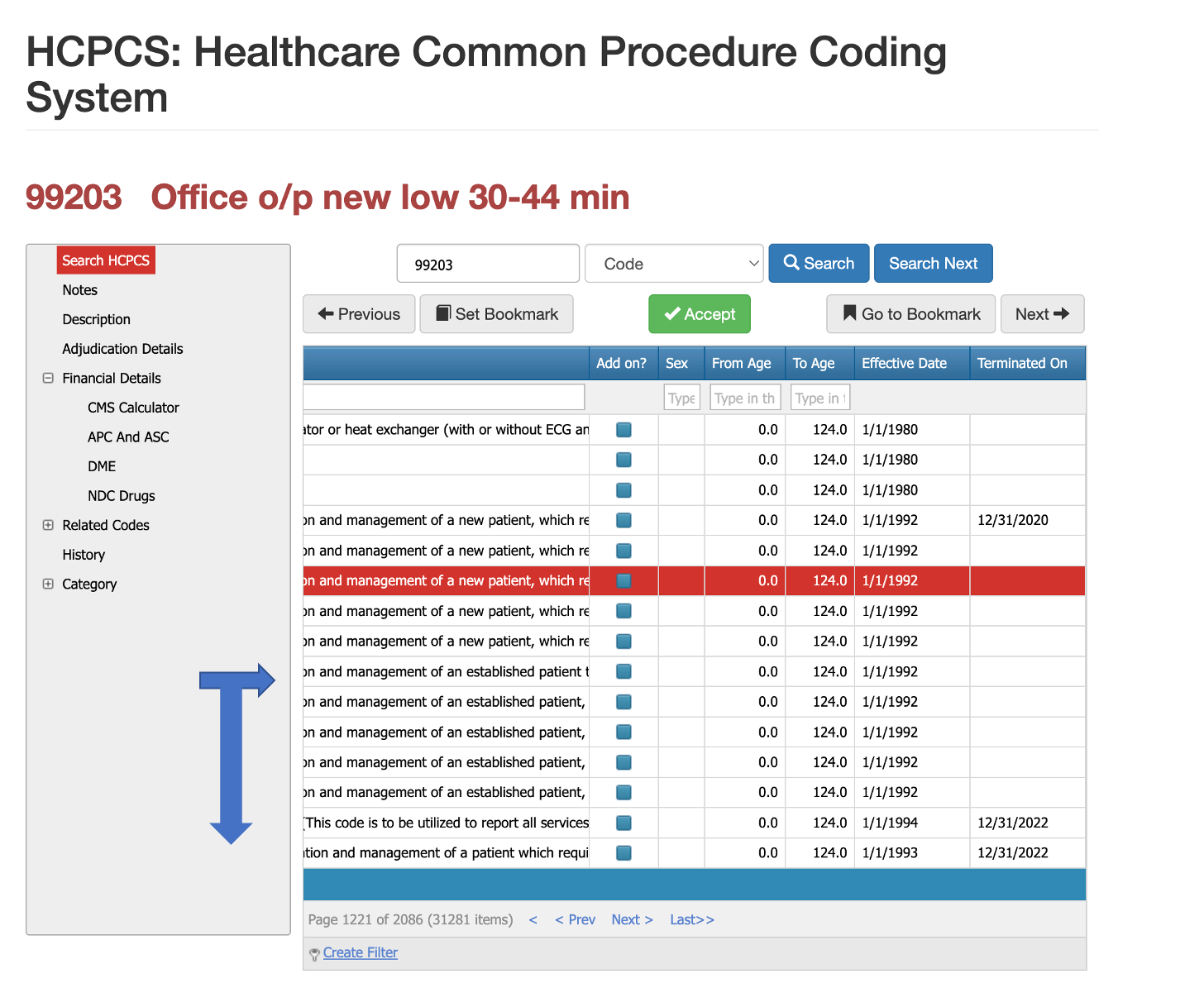

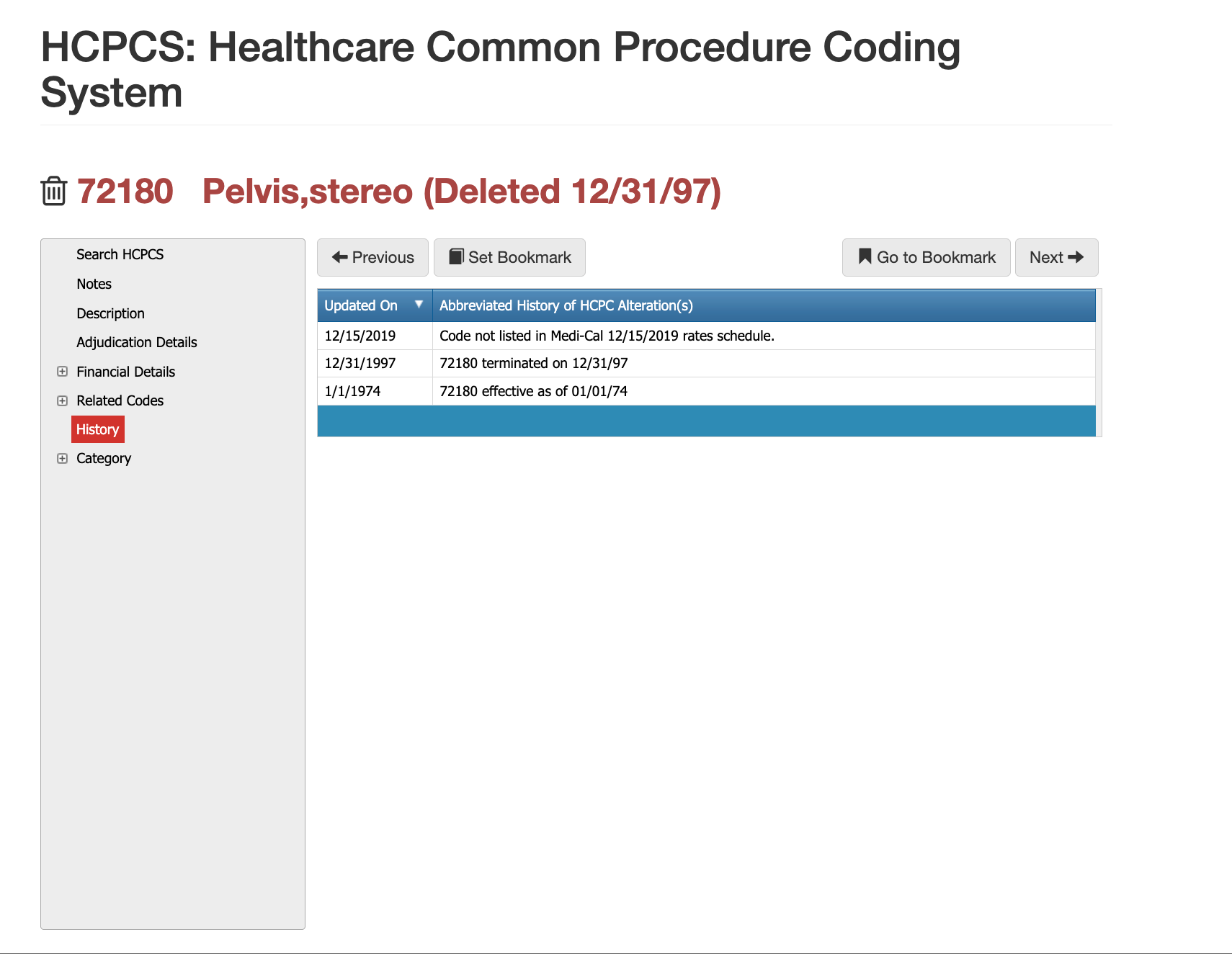

The audit team will thoroughly examine the payer's claims processing systems and procedures. They will assess the accuracy of claims adjudication, verification of beneficiary eligibility, coding and billing practices, and claims payment accuracy. The team will review a sample of claims to identify any irregularities, patterns of errors, or potential instances of fraud, waste, or abuse (FWA).

In addition, the team will assess the

payer's coordination of benefits processes, including the identification of primary and secondary payers, and the appropriate assignment of financial responsibility for services rendered. They will also evaluate the payer's utilization management strategies, such as pre-authorization requirements and medical necessity reviews, to ensure compliance with CMS regulations.

Assessing Compliance with Regulatory Standards

CMS audits place significant emphasis on assessing the payer's compliance with regulatory standards and guidelines. The audit team will review the payer's policies and procedures to ensure adherence to CMS regulations related to enrollment, eligibility verification, and beneficiary protections. They will evaluate the payer's efforts in preventing and detecting FWA, including fraud prevention programs, provider audits, and compliance training.

Furthermore, the team will assess the payer's adherence to quality assurance and performance improvement (QAPI) standards. This includes evaluating the payer's processes for monitoring and improving the quality of care delivered to beneficiaries, as well as their reporting of quality metrics and outcomes.

Throughout the audit process, the CMS audit team will engage in discussions with the payer's staff, seeking clarifications, requesting additional documentation, and addressing any identified issues or concerns. The team will document their findings, observations, and recommendations as they progress through the audit.

Solvency and Reserve Assessment

The audit team evaluates the payer's financial records, including balance sheets, income statements, and reserve calculations. They assess the adequacy of the payer's reserves to ensure their solvency and ability to meet claims obligations. The team analyzes the payer's financial management practices, risk mitigation strategies, and compliance with financial reporting requirements.

Provider Network Management and Adequacy

The audit team examines the payer's provider network management practices to assess the adequacy and accessibility of healthcare services for beneficiaries. They review the payer's processes for contracting with providers, credentialing and enrollment, and maintaining accurate provider directories. The team evaluates the payer's efforts to ensure an adequate number of in-network providers in various specialties and geographic areas.

They also assess the payer's compliance with CMS regulations related to network adequacy and network adequacy reporting. The team examines whether the payer has implemented mechanisms to monitor and address provider network gaps or deficiencies to ensure timely access to care for beneficiaries.

Documentation and Reporting

Following the on-site audit, the CMS audit team will compile their findings and observations into a comprehensive audit report. This report outlines the areas of compliance, deficiencies, and recommendations for corrective actions. The payer will have an opportunity to review and respond to the audit.

Following the on-site audit, the CMS audit team will compile their findings and observations into a comprehensive audit report. This report outlines the areas of compliance, deficiencies, and recommendations for corrective actions. The payer will have an opportunity to review and respond to the audit.

Virtual Examiner is a CMS Audit All-In-One

One valuable resource that can help alleviate the stress, time concerns, team assignments, and the financial repercussions of of an unfavorable CMS Payer Audit, is Virtual Examiner. Virtual Examiner is a AI-driven solution that offers significant positive impacts for payers in terms of auditing their own claims, authorizations, and securing compliance, ultimately leading to financial savings and cost containment.

Virtual Examiner is a powerful tool that utilizes advanced technology, such as artificial intelligence and machine learning algorithms, to analyze and assess large volumes of data efficiently and accurately. By leveraging this technology, payers can conduct comprehensive internal audits to identify any potential errors, inconsistencies, or compliance issues within their claims and authorizations processes. This proactive approach allows payers to address these issues before external audits, such as CMS audits, occur, minimizing the risk of non-compliance and associated penalties.

One of the significant positive impacts of Virtual Examiner is its ability to ensure accurate claims processing and payment. By analyzing claims data against established guidelines and best practices, Virtual Examiner can identify coding errors, billing discrepancies, and potential fraud or abuse patterns. This helps payers reduce payment errors and ensures that claims are processed accurately and in a timely manner. By reducing payment errors, payers can save substantial amounts of money, prevent financial losses, and improve their overall financial stability.

Another positive impact of Virtual Examiner is its role in securing compliance with regulatory standards. By continuously monitoring claims and authorization processes, Virtual Examiner can identify deviations from CMS guidelines and other regulatory requirements. It helps payers stay updated with changing regulations, ensuring that their operations align with the latest compliance standards. This proactive compliance monitoring minimizes the risk of penalties, legal issues, and reputational damage for payers. Moreover, Virtual Examiner enables payers to streamline their compliance efforts by providing real-time alerts and actionable insights, allowing them to promptly address any compliance gaps or issues that may arise.

Furthermore, Virtual Examiner plays a critical role in cost containment for payers. By identifying potential billing errors, unnecessary procedures, and inefficient utilization of resources, Virtual Examiner helps payers reduce unnecessary costs and improve cost efficiency. By identifying areas of improvement and implementing targeted interventions, payers can optimize their operations, reduce waste, and contain costs without compromising the quality of care provided to beneficiaries.

Overall, the positive impact of having Virtual Examiner as a resource for proper auditing, compliance, and cost containment cannot be overstated, and should be strongly considered for any at-risk payer organization.

CMS Payer Audit 101

Effective auditing, compliance, and cost containment are essential for health insurance payers to ensure financial stability, maintain positive payer-beneficiary relationships, and deliver high-quality care. Throughout this article, we have explored the various aspects of CMS audits, the role of payers, and the positive impacts of utilizing Virtual Examiner as a resource for proper auditing, compliance, and cost containment.

CMS audits, while necessary for regulatory compliance, can be time-consuming, financially burdensome, and can potentially harm payer-beneficiary relationships if not handled appropriately. However, Virtual Examiner offers a solution to mitigate these negative implications by enabling payers to audit their own claims, authorizations, and secure compliance more efficiently.

By leveraging advanced technology, Virtual Examiner empowers payers to proactively identify and address errors, inconsistencies, and compliance issues before external audits occur. Its ability to analyze large volumes of data using artificial intelligence and machine learning algorithms ensures accurate claims processing, minimizes payment errors, and reduces financial losses. Furthermore, Virtual Examiner's continuous monitoring of claims and authorizations helps payers maintain compliance with regulatory standards, reducing the risk of penalties and legal issues.

Cost containment is another critical area where Virtual Examiner proves invaluable. By identifying potential billing errors, unnecessary procedures, and inefficient resource utilization, Virtual Examiner enables payers to reduce unnecessary costs and optimize their operations. This approach improves cost efficiency while maintaining the quality of care provided to beneficiaries.

Moreover, Virtual Examiner provides payers with data-driven insights and analytics, enabling them to make informed decisions and develop targeted interventions. By leveraging these insights, payers can enhance their performance, streamline operations, and deliver better outcomes for beneficiaries.

In conclusion, Virtual Examiner offers a comprehensive solution to the challenges faced by health insurance payers in auditing, compliance, and cost containment. By considering Virtual Examiner as a resource, payers can avoid time-consuming external audits, minimize financial risks, and strengthen their payer-beneficiary relationships. The adoption of Virtual Examiner not only ensures accurate claims processing, regulatory compliance, and cost efficiency but also empowers payers to deliver high-quality care to their beneficiaries.

Take action today and explore the benefits of Virtual Examiner as a resource to avoid time-consuming and financially burdensome external audits. Embrace technology-driven solutions that offer accurate auditing, streamlined compliance, and effective cost containment. By incorporating Virtual Examiner into your payer operations, you can mitigate the negative implications of audits and safeguard your financial stability and reputation while improving the quality of care provided to your beneficiaries.

Will Schmidt joined PCG Software as their Chief Strategy Officer in November 2022. Prior to PCG, Schmidt lead TNH as their Sr. Vice President to become the 7th largest pharmacy in the nation. He then went on to consult with and serve as Interim CEO or Consultant to over 20 different companies specializing in profit strategies, operational efficiencies, vendor relations and partnerships, and exit strategies, include an international Revenue Cycle Management Company.

Our History and Credibility in Reporting this Information:

For over 30 years, PCG Software Inc. has been a leader in AI-powered medical coding solutions, helping Health Plans, MSOs, IPAs, TPAs, and Health Systems save millions annually by reducing costs, fraud, waste, abuse, and improving claims and compliance department efficiencies. Our innovative software solutions include Virtual Examiner® for Payers, VEWS™ for Payers and Billing Software integrations, and iVECoder® for clinics.