✅ 100% potential compliance

✅ Maximized claim line item savings

✅ 72+ million edits

✅ CCI, CMS, AMA, Medicaid

✅ 99% see ROI in 90 days

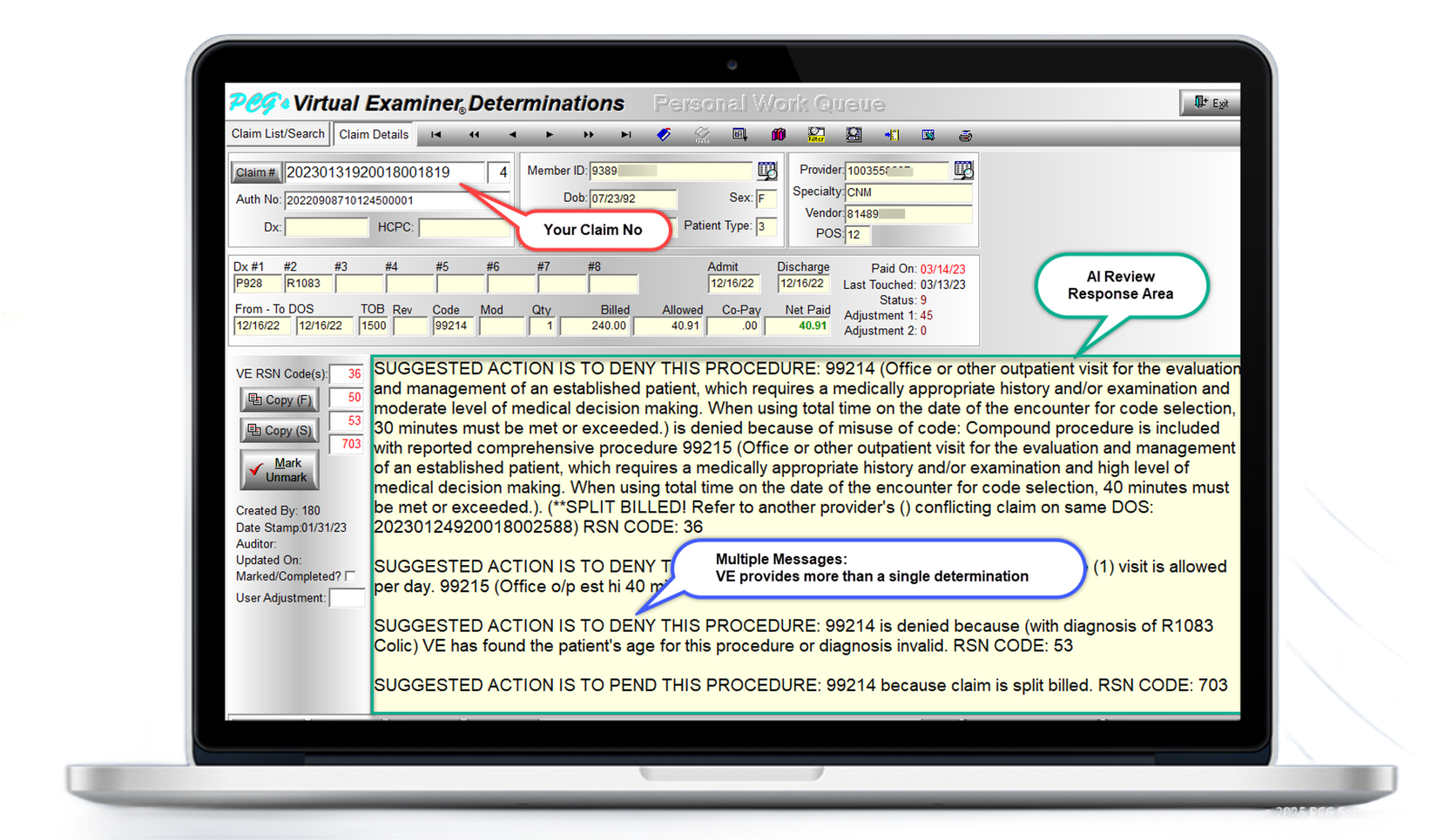

Virtual Examiner® (VE)

#1 Claims Auditing Software for Payer Organizations

Without VE's AI claims auditing you're losing money right now

There are numerous factors—such as duplicates, split billing, unbundling, global periods, improper modifier usage, and over 480 additional reasons—that could justify the denial or reduction of the claim you are currently examining. However, without VE to thoroughly investigate the complete billing history of both the patient and provider, these issues may go unnoticed. As a result, you risk approving a claim that is either excessively priced or shouldn't be reimbursed at all.

Save millions in denials & reductions

Virtual Examiner does the work of 1000's of Auditors

While you and your team rest, VE meticulously audits today's claims against three (3) years of patient billing history. Upon identifying coding and claims errors, it quarantines these claims into your Virtual Reporter module for human review each morning. Your team then clocks in, logs in, and applies the necessary edits for maximized savings down the claim line item.

What is Episode of Care Auditing?

Episode of Care Auditing examines the entire 3-year billing history surrounding a claim — not just today’s line item. VE connects every related visit, procedure, diagnosis, and provider interaction to uncover duplicates, split billing, unbundling, invalid modifiers, and 480+ other reasons a claim should not be paid as submitted. This is the foundational feature that makes VE the most advanced AI claims auditing software on the market and the reason payers see savings immediately.

How VE looks at duplicates

Duplicate claims are one of the biggest drivers of avoidable overpayments. VE’s AI cross-matches every claim across multiple years, providers, and service dates to detect exact duplicates, near-duplicates, and rebilled claims hidden by modifier changes. VE’s duplicate review logic is updated quarterly with CMS, Medicaid, and AMA rules — ensuring your team flags errors before they’re paid and preventing retroactive recoveries.

How VE helps with reductions

VE identifies procedures that should be reduced due to bilateral rules, global periods, mutually exclusive procedures, or incorrect units — all automatically flagged overnight. Every recommendation includes the CMS, AMA, or Medicaid policy behind the reduction so your team can process edits with confidence. These real-time savings are a major reason VE users see 90-day ROI.

Virtual Examiner has 72+ million edits!

Our 72+ million edit library is the largest and most comprehensive in the industry — covering CMS, Medicaid, Medi-Medi, AMA, ASC, CCI, and our proprietary knowledge base. VE analyzes every claim through this engine nightly, ensuring your team receives the most accurate, policy-aligned results possible. This is why VE consistently outperforms other claims editing systems and why payers rely on VE for long-term compliance, cost containment, and audit accuracy.

#1 FWA and Compliance Software

Increased compliance, recoveries, and strategies

Once you've launched VE and are auditing your claims every day, it's time to kick your FWA process into high gear. Your new FWA module will enable you to conduct targeted FWA investigations into specific categories that apply fairly across all providers, thereby avoiding selective auditing and provider retaliation while enhancing your compliance and recovery efforts.

How does VE help investigate FWA?

With VE's provider profiling and audit reporting tools, your team can pinpoint outliers in minutes—not months. Run targeted reports by code, category, provider, or service type to uncover abnormal patterns, high-risk billing behaviors, or opportunities for recoveries. Whether you're identifying a single provider with repeated errors or analyzing system-wide trends across thousands of claims, VE gives you the clarity needed for coaching, corrective action, or deeper FWA review. These insights help you improve payment accuracy, strengthen provider relations, and proactively address issues long before they escalate into costly audits or investigations.

How VE helps you remain complaint with CMS

VE’s quarterly updates include all CMS National Correct Coding Initiative (NCCI) edits, Medicare coverage rules, modifier changes, telehealth updates, and global period revisions. Each VE determination cites the exact CMS rule that applies to the claim, helping your team remain audit-ready and avoiding CMS overpayment demand letters or penalties.

How VE helps you remain compliant with Medicaid

Medicaid rules vary by state — and VE accounts for them. VE includes Medicaid, Medi-Medi, and state-specific edits so your team can confidently adjudicate claims using real regulated policy. Payers use VE to avoid incorrect approvals, reduce Provider Appeal exposure, and stay compliant with Medicaid guidelines across all lines of business.

Empowering Your Claims & SIU

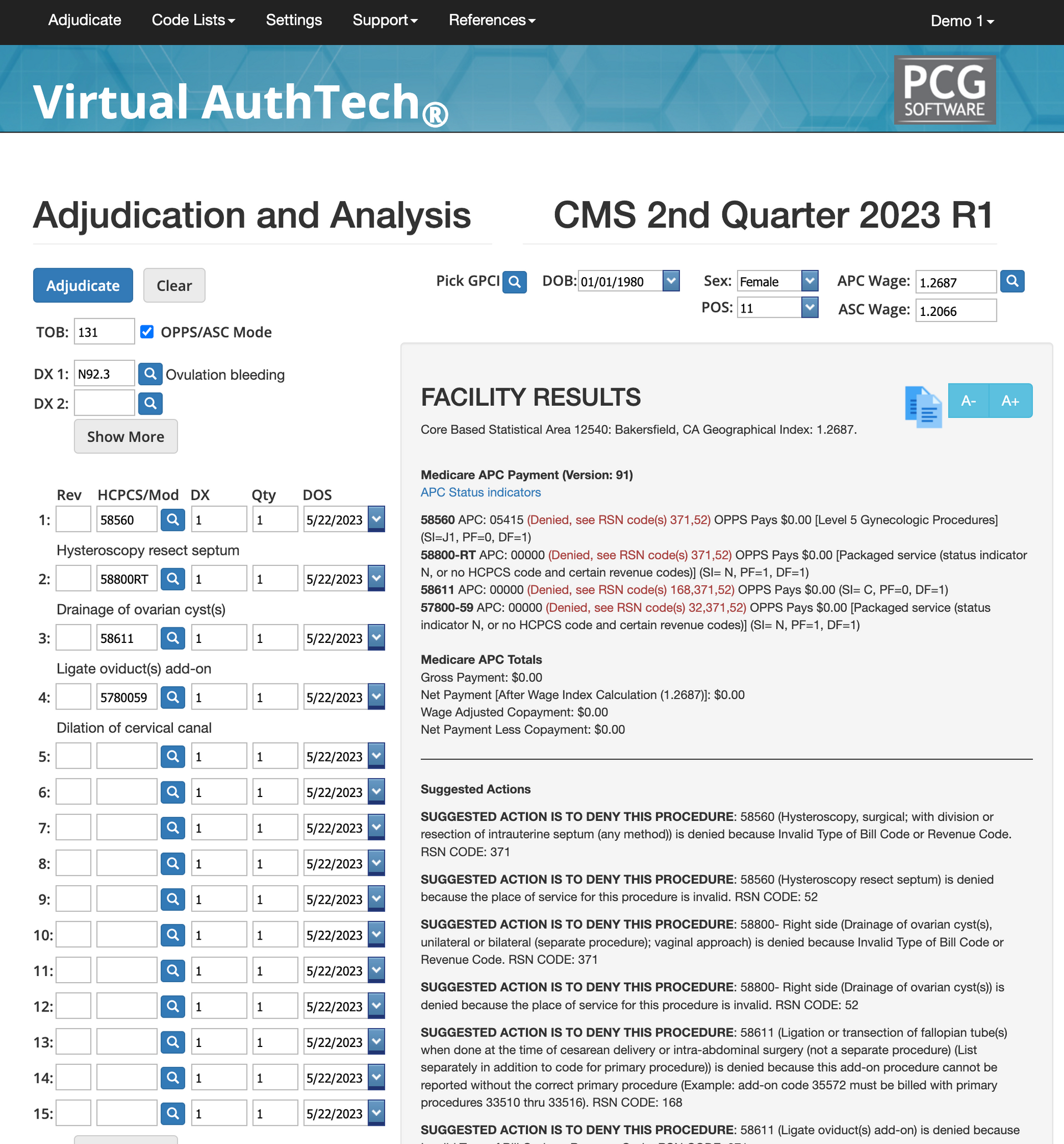

Virtual AuthTech® (VA) is included!

With your new Virtual AuthTech® module, your Medical Management and Authorizations teams will be equipped to review complex authorizations and run mock adjudications to avoid erroneously approving claims that are not medically necessary, fall under a CCI edit, or hundreds of other reasons to which Virtual AuthTech within it’s Machine Learning AI Knowledge base will advise you on next steps.

What is a code scrubber?

VA is a next-generation code scrubber that analyzes authorizations and medical management decisions before the claim is paid. It identifies incorrect CPT/HCPCS pairings, medically unnecessary services, missing documentation, invalid modifiers, global period conflicts, and more. This ensures clean, policy-compliant decisions that prevent future denials, appeals, and retroactive overpayment audits.

How does VA help Medical Management?

VA gives Medical Management teams instant policy validation for authorizations. It identifies high-risk services, tests medical necessity, flags inappropriate combinations, and prevents costly misjudgments. This reduces provider abrasion, lowers avoidable medical spend, and keeps your utilization management team aligned with CMS, AMA, ASC, and Medicaid policy rules.

How does VA help Claims Departments?

Claims teams use VA to perform mock adjudications on complex claims before payment. VA displays coding conflicts, coverage limitations, bundling rules, and expected reductions so your team can approve or deny correctly the first time. This drastically reduces rework, overturn rates, and downstream audits — strengthening both provider relationships and payment integrity.

Maximized Payment Integrity and Security

Virtual Examiner is an IntraNet Solution!

PCG has never experienced a data breach in over 30 years because we never "receive" your data or claims. Virtual Examiner becomes your software, cost containment solution, and FWA solution. Within days of an agreement, we've installed VE's 72+million edits into your dedicated server and set up quarterly code updates. That's right, you own VE from Day One!

How is Virtual Examiner integrated with your claims software?

VE is installed directly on your secure intranet server. Payers simply export their daily claims file (837 or flat file), drop it into VE, and retrieve the audited file with all rules, reductions, and duplicate checks applied. No data leaves your network. VE functions as an internal AI claims editing engine that enhances whatever claims system you are already using.

How do you get Quarterly code and rule updates?

Your VE team receives quarterly code updates via a secure SFTP connection. Updates include CMS, AMA, Medicaid, ASC, and CCI revisions, plus PCG’s enhanced auditing logic. These updates ensure your software always reflects the most current national rules — protecting compliance and avoiding revenue loss.

We never see or receive your data!

Virtual Examiner is a 100% intranet-based solution. PCG never receives, stores, or transmits your data. This is why PCG has never experienced a data breach in over 30 years — nothing leaves your environment. VE becomes your internal claims auditing, FWA, and compliance engine from day one.

Client Results & FREE Audits

99% of clients see an ROI In 90 days or less!

In our 30+ year history, VE has saved our clients millions in claims denials and reductions and countless in CMS and Medicaid compliance, but what's most exciting is that after 90 days, VE has already paid for itself. This is why we're performing new 3-year FREE claims audit every single month for new prospective clients.

What do we need to start a FREE audit

You’ll sign a Mutual NDA and BAA, then securely send three years of claims data. We analyze the data for 3–5 weeks and return a full findings presentation including dollar savings, compliance exposure, duplicate trends, and ROI projections. This audit is completely free and requires no commitment.

How our clients getting a 90-Day positive ROI?

Most organizations see ROI in under 90 days because VE immediately identifies duplicate payments, incorrect codes, global conflicts, and unbundled procedures. These savings occur before your team even finishes implementation. VE’s combination of automation and accuracy is the reason payers see measurable results faster than any other claims auditing software.

How does implementation and training work?

Installation is completed in 1–2 weeks on your secure intranet. We then conduct a 5-day onsite training with your Claims, SIU, and Medical Management teams. Week One you are fully operational, auditing live claims, and generating immediate savings. No lengthy onboarding, no outsourcing, no delays.

How to Get Started with Virtual Examiner

1

45 minute VE demo & intro

Meet with our CSO on a 45-minute call to go over your needs, a short VE demo and to make sure it's worth both our times to move forward with an audit.

2

3-Year Claims Audit Analysis

After the BAA and NDA are signed, you submit 3 years of claims data to us and give us 3-5 weeks to analyze the data and present how to save money and increase compliance.

3

On-Site Audit Reveal

We fly to your headquarters and meet with all decision makers, present VE findings, ROI, a strategy to audit going foward with or with out VE, and then give you a proposal.

4

Implementation and Go-Live

If you agree to the price and terms, we get VE installed within 1-2 weeks and then coordinate a full 5-day onsite training with your claims team. Week One we're auditing claims and providing an immediate ROI with VE!