California's New Law: Health Plans Must Pay Providers Within 30 Calendar Days

Quick Summary of the Health Plan Payment Deadline Law Change:

California's healthcare reimbursement landscape has undergone a significant transformation with the introduction of AB 3275, which mandates that health plans, including HMOs and Medi-Cal managed care plans, must pay providers within 30 calendar days instead of the previous 30 working days. This legislative update is signed into law by Governor Gavin Newsom to expedite reimbursements and improve cash flow for healthcare providers. However, the law also introduces operational challenges for health plans, managed service organizations (MSOs), and independent physician associations (IPAs) as they adjust processes, staffing, and technology to comply with the new requirements.

The Change: From Working Days to Calendar Days

Under the previous law, health plans must reimburse clean claims within 30 working days of receipt, excluding weekends and holidays. This effectively provided health plans up to 6 weeks to process claims. AB 3275 simplifies the timeline, requiring reimbursement within 30 calendar days, which includes weekends and holidays.

In cases where claims are contested, health plans must notify the claimant in writing within the same 30-calendar-day period. If claims remain unpaid past the deadline, interest will accrue at 15% per annum, and plans that fail to pay interest automatically will owe more than $15 or 10% of the accrued interest.

While this shift ensures faster provider payments, it places new burdens on health plans to enhance efficiency and accuracy within a much stricter window.

Impact on Health Plans, MSOs, and IPAs

1. Operational Efficiency

The compressed timeline requires health plans, MSOs, and IPAs to re-engineer their claims processing workflows for faster turnaround times.

- Process optimization: Review existing systems and workflows to identify delays or bottlenecks. Tasks such as claim intake, validation, and approval must be streamlined to avoid compliance risks.

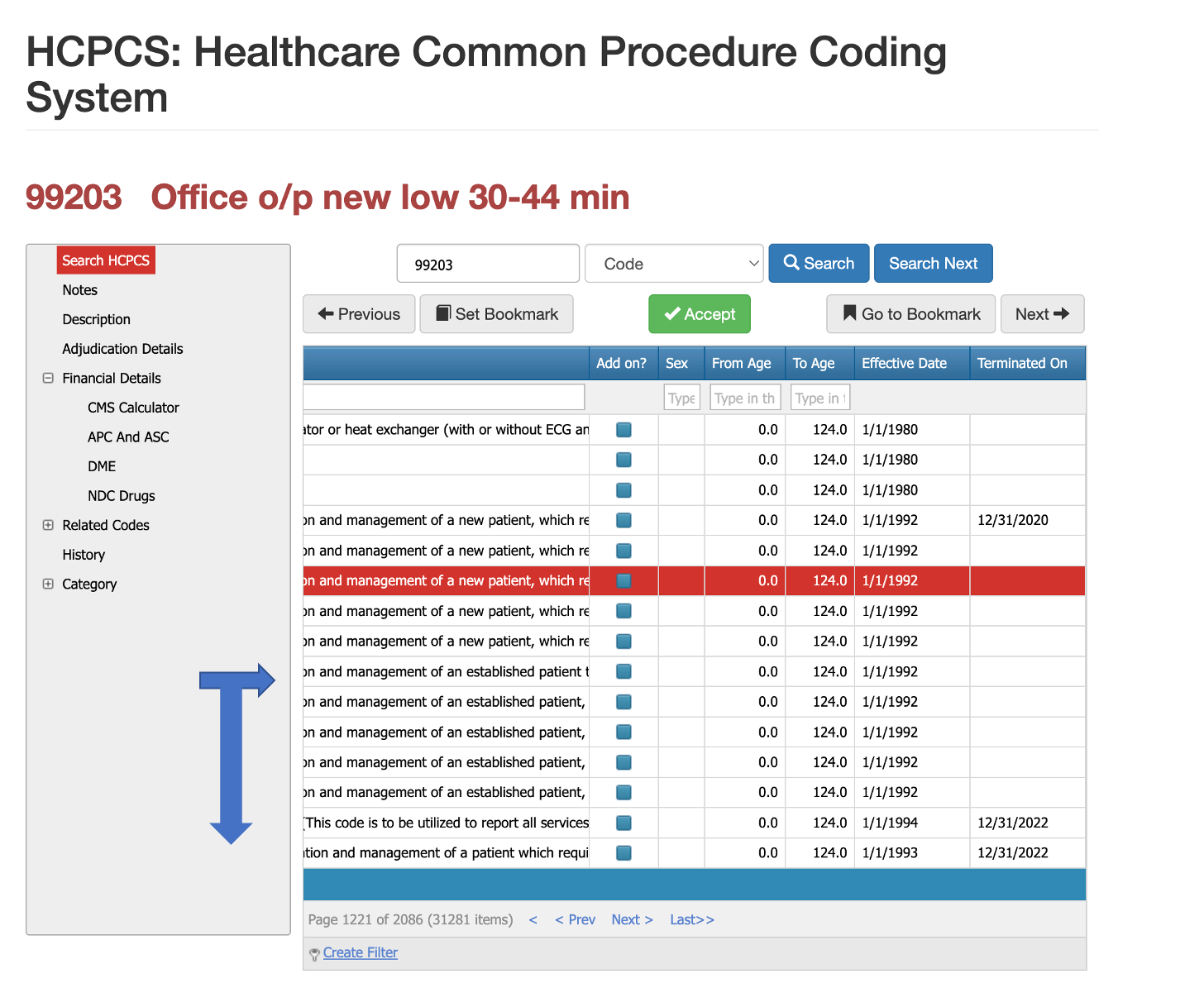

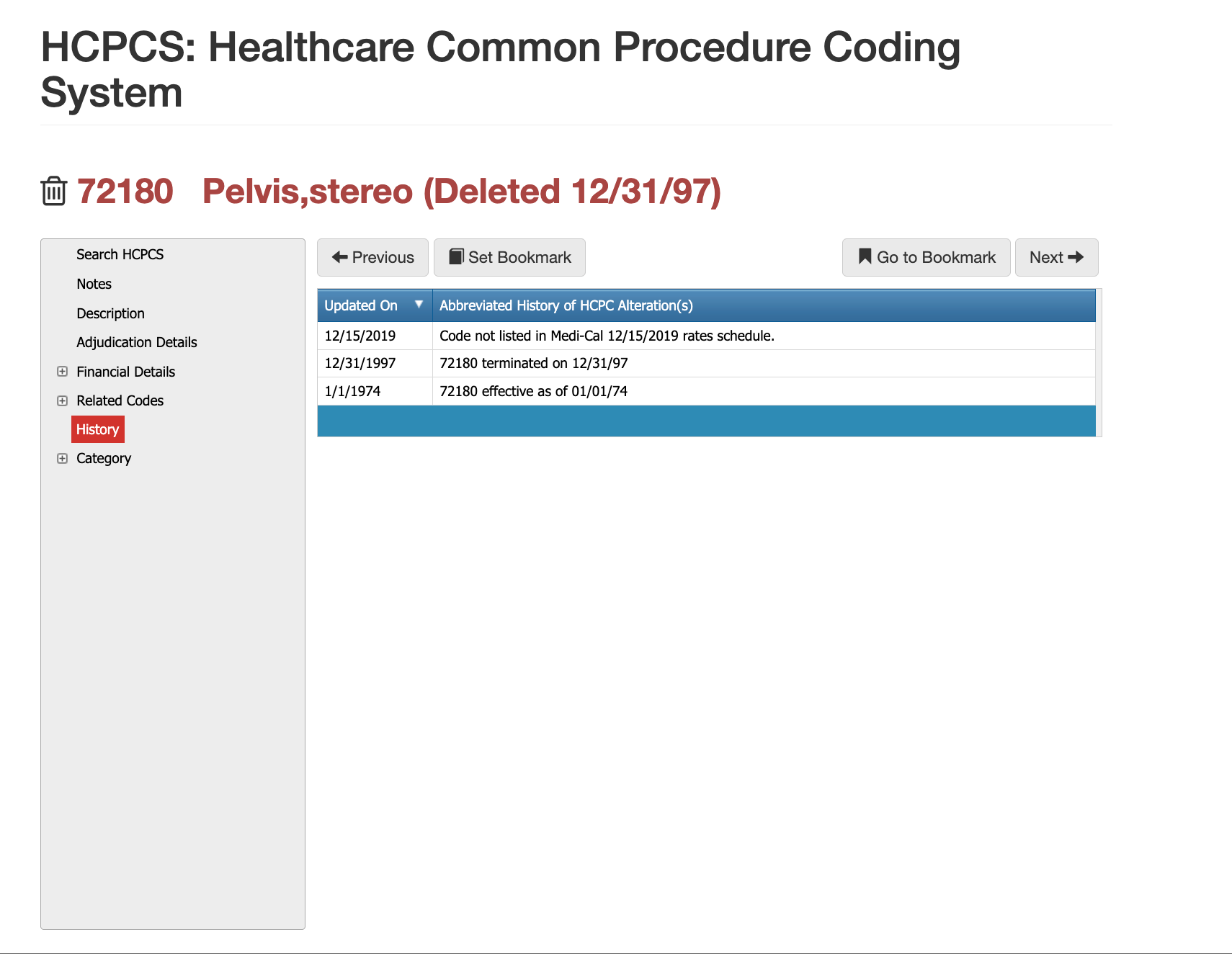

- Automation adoption: Health plans may need to adopt AI-powered claims processing and adjudication systems to minimize manual intervention and accelerate clean claim resolution.

- Performance monitoring: Real-time tracking of claims at each stage will be essential to ensure timely payments and compliance with the new law.

2. Additional Hiring Requirements

Some health plans may need to scale up their claims processing teams to meet the new deadline to avoid delays.

- Staffing challenges: Increased labor costs may result from plans to hire additional personnel to handle higher workloads.

- Temporary vs. permanent staffing: While short-term hiring may address immediate concerns, over-reliance on human resources may prove unsustainable. Investing in technology-driven solutions can reduce headcount dependency over time.

3. Impact on Payment Accuracy and Error Rates

The shorter reimbursement window increases the risk of payment errors, including overpayments, underpayments, and denials. Errors can have serious consequences for health plans:

- Financial risks: Incorrect payments can trigger costly reprocessing efforts and potential penalties for non-compliance.

- Provider relationships: Increased errors may damage provider relationships, leading to dissatisfaction and disputes.

- Regulatory scrutiny: Plans failing to meet the 30-day timeline could face heightened regulatory oversight and enforcement actions.

4. Adoption of Auditing and Claims Software

Health plans will likely turn to advanced auditing software and automation tools to manage the tighter reimbursement deadline and minimize errors.

- Error prevention: Real-time claims auditing software can identify errors before claims are finalized, reducing inaccuracies and ensuring compliance.

- Scalability and efficiency: AI-driven adjudication tools allow health plans to process high volumes of claims quickly, reducing reliance on manual reviews.

- Cost optimization: By leveraging technology, health plans can meet the new regulatory requirements without significantly increasing staffing costs.

Key Considerations for C-Suite Leaders

For directors, vice presidents, and C-suite executives, AB 3275 presents both challenges and opportunities:

- Strategic investments: Leaders must prioritize investments in technology, such as claims automation, auditing software, and process optimization tools, to meet compliance without increasing costs.

- Risk mitigation: Plans must develop strategies to address payment error risks, including real-time monitoring and audits.

- Workforce planning: Balancing short-term staffing needs with long-term technology adoption is critical to achieving operational sustainability.

- Compliance readiness: Proactively reviewing systems and processes now will ensure compliance well before the January 1, 2026, implementation date.

How PCG Software can Help during this transition...

For over 30 years, PCG Software and its flagship claims auditing solution, Virtual Examiner®, have empowered more than 164 payers to audit billions of claims, saving billions of dollars in incorrect payments while enhancing compliance. Built on CMS, Medi-Cal, WHO, DHHS, and State Medicaid guidelines, our software is updated weekly to reflect the latest rules and regulations. Virtual Examiner® gives health plans unmatched clarity and control, allowing leadership to walk into the office every morning with actionable insights: identifying problematic claims, understanding root causes, and implementing targeted solutions.

Most importantly, Virtual Examiner® maintains the human element—placing the ultimate decision to deny, reduce, or pend claims for review firmly in the hands of your team—combining advanced automation with the oversight that only experienced professionals can provide.

Our History and Credibility in Reporting this Information:

For over 30 years, PCG Software Inc. has been a leader in AI-powered medical coding solutions, helping Health Plans, MSOs, IPAs, TPAs, and Health Systems save millions annually by reducing costs, fraud, waste, abuse, and improving claims and compliance department efficiencies. Our innovative software solutions include Virtual Examiner® for Payers, VEWS™ for Payers and Billing Software integrations, and iVECoder® for clinics.